- Serbia

Get to know Serbia

- Citizens

Culture and science

Health services

Pension and disability insurance

- Business

Employment

Economy

- Media

- Government

- Contact

Keep in touch

Contact form

Back

Keepin touch

Whether you have a question, comment, suggestion or any problem in the purview of the government, send us your message and we will try to respond as soon as possible. If your problem is not in our purview, we will forward your message to the relevant institution.

Q:

A:

More than $1 billion foreign direct investment since the beginning of year

Belgrade,

29 September 2005

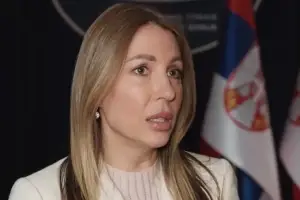

Director of the Serbian Investment and Export Promotion Agency (SIEPA) Jasna Matic said today that since the beginning of the year, Serbia has received more than a billion dollars in foreign direct investment, and the government anticipates this amount to reach $2 billion by the year’s end.

At a presentation of the UNDP’s report on international investments in 2005, Matic said that in the upcoming period there will be an investment boom in Serbia, particularly thanks to Serbia’s leading position in the region, its qualified workforce and industrial potential.

According to Matic, in the past several years there has been a constant increase in foreign direct investment in Serbia, and it is expected to reach a record this year, while the next year this number can be even higher, though this will depend on the success of privatisation of public companies.

According to the World Bank, Serbia has achieved the best results in the implementation of reforms in business in relation to other countries, but it has not yet been included in the UNDP research, Matic said.

She stressed that Serbia has to turn to innovation and exploration techniques if it is to become competitive and attract more foreign investment.

According to Matic, Serbia must focus on the EU and on its relatively sophisticated workforce that will be able to produce complicated products and then dispatch them to European countries expediently and on time.

Along with the improvement of human resources, Serbia also needs to work on improving its regulative framework, as well as the telecommunications sector, because globalisation, research and development are solely the result of the advancement of telecommunication technologies. Therefore we need to start a process of serious reformation and privatisation of the telecommunications sector, said Matic.

Head of the Managing Board of the Societe General Bank Goran Pitic pointed out that the major part of foreign investment in the world goes into the sector of financial services. This proves that Serbia does not lag behind the rest of the world, because the year 2005 will certainly be marked by an inflow of investment, especially in the banking sector.

The UNDP deputy standing representative to Serbia-Montenegro Rastislav Vrbensky said that the UN report on world investment in 2004 shows that the inflow of foreign direct investment on global level, after it had been decreasing for three years, in 2004 rose by two percent, totalling $648 billion. He said that the inflow of investment in developing countries has risen by 40 percent, totalling $233 billion, which is the second highest figure ever, adding that the money did not go only to India and China, but to southeastern Europe as well, which is increasingly becoming a target for direct investment.

Vrbensky said that big transnational corporations, which contribute two-thirds of all investment throughout the world are turning toward the markets of developing countries.

According to Matic, in the past several years there has been a constant increase in foreign direct investment in Serbia, and it is expected to reach a record this year, while the next year this number can be even higher, though this will depend on the success of privatisation of public companies.

According to the World Bank, Serbia has achieved the best results in the implementation of reforms in business in relation to other countries, but it has not yet been included in the UNDP research, Matic said.

She stressed that Serbia has to turn to innovation and exploration techniques if it is to become competitive and attract more foreign investment.

According to Matic, Serbia must focus on the EU and on its relatively sophisticated workforce that will be able to produce complicated products and then dispatch them to European countries expediently and on time.

Along with the improvement of human resources, Serbia also needs to work on improving its regulative framework, as well as the telecommunications sector, because globalisation, research and development are solely the result of the advancement of telecommunication technologies. Therefore we need to start a process of serious reformation and privatisation of the telecommunications sector, said Matic.

Head of the Managing Board of the Societe General Bank Goran Pitic pointed out that the major part of foreign investment in the world goes into the sector of financial services. This proves that Serbia does not lag behind the rest of the world, because the year 2005 will certainly be marked by an inflow of investment, especially in the banking sector.

The UNDP deputy standing representative to Serbia-Montenegro Rastislav Vrbensky said that the UN report on world investment in 2004 shows that the inflow of foreign direct investment on global level, after it had been decreasing for three years, in 2004 rose by two percent, totalling $648 billion. He said that the inflow of investment in developing countries has risen by 40 percent, totalling $233 billion, which is the second highest figure ever, adding that the money did not go only to India and China, but to southeastern Europe as well, which is increasingly becoming a target for direct investment.

Vrbensky said that big transnational corporations, which contribute two-thirds of all investment throughout the world are turning toward the markets of developing countries.

-

Belgrade, 19 January 2026

Belgrade, 19 January 2026Deal reached on key provisions of NIS sale and purchase agreement

-

Belgrade, 16 January 2026

Belgrade, 16 January 2026More than one-third of Growth Plan funds directed to energy sector

-

Belgrade, 15 January 2026

Belgrade, 15 January 2026Goal to finalise NIS negotiations by end of week

-

Belgrade, 23 December 2025

Belgrade, 23 December 2025Enhancing implementation of IPARD III programme

-

Belgrade, 12 December 2025

Belgrade, 12 December 2025Construction of gas interconnector with North Macedonia by end-2027

-

Belgrade, 8 December 2025

Belgrade, 8 December 2025Enormous public interest in registering illegal facilities

-

Belgrade, 8 December 2025

Belgrade, 8 December 2025State doing everything to preserve stability of energy supplies

-

Belgrade, 5 December 2025

Belgrade, 5 December 2025State doing everything to avoid shortage of oil derivatives

-

Belgrade, 2 December 2025

Belgrade, 2 December 2025Serbia has not received positive decision from US over NIS

-

Belgrade, 2 December 2025

Belgrade, 2 December 2025Spanish companies invited to invest in Serbian agriculture